change in net working capital calculation

So the change in NWC is 135000. In this video on Changes in Net Working Capital here we discuss this topic in detail including its meaning formula calculation of changes in working capit.

Net Working Capital Definition Formula How To Calculate

Change in net working capital calculation Samuels Manufacturing is considering the purchase of a new machine to replace one it believes is obsolete.

. As per the above table the Net Working Capital of Jack and Co. Cash Flow To Common Stockholders. Net working capital is also known simply as working capital.

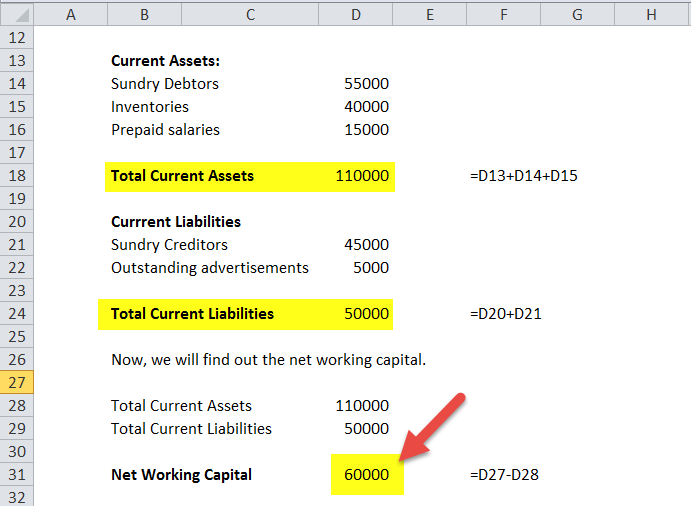

Current Operating Liabilities 40mm AP 20mm Accrued Expenses 60mm. Changes in Net Working Capital Step by Step Calculation. Calculate The Change In NWC.

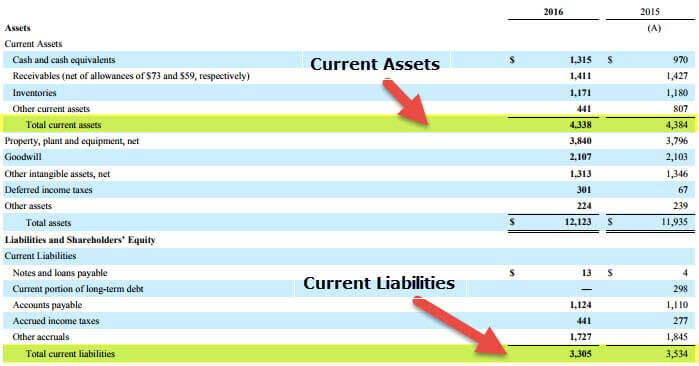

NWC Cash cash equivalents Inventory Marketable investments Trade accounts receivable - Trade accounts payable. Changes in working capital -2223. As a result of the proposed replacement the following changes are anticipated in the levels of the current asset and current liability accounts noted.

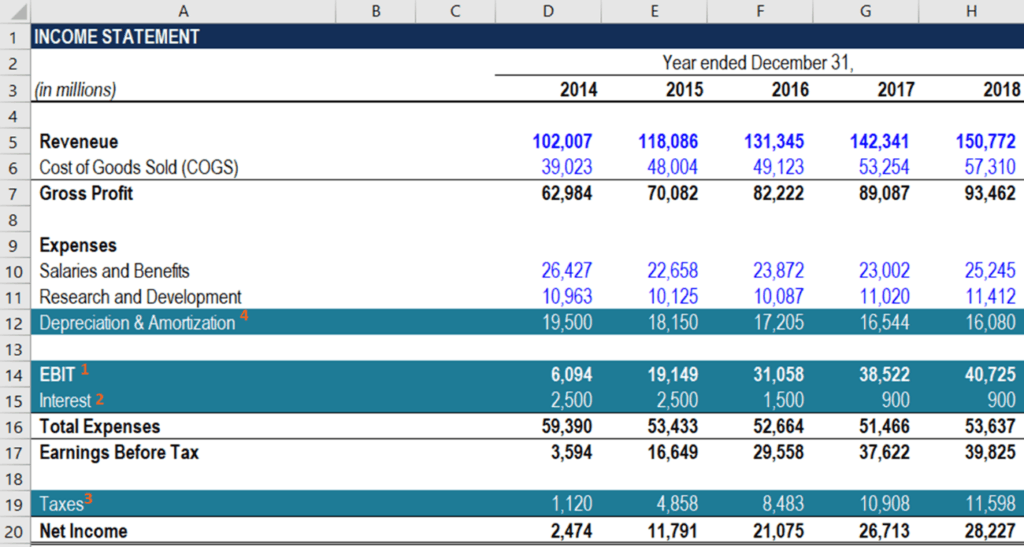

Calculating changes in net working capital from one period to another is significant for a company to get a clear image of its cash position. If the price per unit of the product is 1000 and the cost per unit in inventory is 600 then the companys working capital will increase by 400 for every unit sold because either cash or accounts receivable. Owner Earnings 8903 14577 5129 13312 2223 13084.

Tack för ditt meddelande. Within the 1 st tab named Method 1 you can determine the absolute value of the net working capital by this formula. This means that a company may be unable to account for sudden changes as they occur.

For most companies you analyze by using the change in working capital in this way the FCF calculation and owner earnings calculation is similar as it was for Amazon and Microsoft. Subtract the previous years working capital from the current years working capital according to the calculations made above in the table. In this example net working capital has increased by 3000.

Change in net working capital calculation Samuels Manufacturing is considering the purchase of a new machine to replace one it believes is obsoleteThe firm has total current assets of 930000 and total current liabilities of 644000. NWC is a way of measuring a company. A consistent positive change should ring the alarm bells that the cash balance is reducing.

Apply Now Get Low Rates. 38500 29000. Net working capital is solely based on data.

Now Changes in Net Working Capital 12500 9500 3000. XL-M Nordic AB Hamnvägen 3. Cost of Trade Credit.

Example calculation with the working capital formula. An increase in net working capital means cash outflow and vice versa. Its also important for predicting cash flow and debt requirements.

08 740 33 33 E-mail. As a result of the proposed replacement the following changes are anticipated. Changes in Net Working Capital Ending Net Working Capital - Beginning Net Working Capital.

Typically companies calculate net working capital using the most recent financial data. Cash and Cash Equivalents Trade Accounts Receivable Inventories Debtors Creditors Short-Term Loans 135000 55000. Positive cash flow indicates that a companys liquid assets are increasing.

Tack vi ringer dig så snart som möjligt. This problem has been solved. Net working capital NWC is current assets minus current liabilities.

A company can increase its working capital by selling more of its products. Net Working Capital NWC 75mm 60mm 15mm. When there are increases in the current assets of a company that would be cash outflow.

As for the rest of the forecast well be using the. Net Working Capital Formula Current Assets Current Liabilities. Cash Flow is the net amount of cash and cash-equivalents being transferred in and out of a company.

Pvt Ltd is as follows. Current Operating Assets 50mm AR 25mm Inventory 75mm. Calculating change in net working capital is part of the operational cash flow since the companies commonly have assets and liabilities that are both current to decrease and increase for their ongoing operations to be funded.

Moreover it is equally vital for a company to track those changes to manage its operating cash flows properly. 240000 2022 105000 2021 135000. The firm has total current assets of 925000 and total current liabilities of 644000.

Within the 2 nd tab named Method 2 you can calculate the net working ratio by applying this equation. If companies lack the necessary data to calculate net working capital the results will be inaccurate. Its a calculation that measures a businesss short-term liquidity and operational efficiency.

Ad Compare Top 7 Working Capital Lenders of 2022. This change in working capital is reflected in the cash flow statements to calculate cash flows from operations. Given those figures we can calculate the net working capital NWC for Year 0 as 15mm.

The last step is to determine the change in working capital by using the formula.

Working Capital Formula And Calculation Exercise Excel Template

Change In Net Working Capital Nwc Formula And Calculator

Change In Working Capital Video Tutorial W Excel Download

Cash Flow Formula How To Calculate Cash Flow With Examples

Net Working Capital Formula Calculator Excel Template

Working Capital Formula And Calculation Exercise Excel Template

Change In Net Working Capital Nwc Formula And Calculator

Working Capital Formula And Calculation Exercise Excel Template

Change In Working Capital Video Tutorial W Excel Download

Change In Net Working Capital Nwc Formula And Calculator

Net Working Capital Formula Calculator Excel Template

Change In Working Capital Video Tutorial W Excel Download

How To Calculate Fcfe From Ebit Overview Formula Example

Change In Working Capital Video Tutorial W Excel Download

Net Working Capital Definition Formula How To Calculate

Changes In Net Working Capital All You Need To Know

Working Capital Formula And Calculation Exercise Excel Template

Change In Net Working Capital Nwc Formula And Calculator

Net Working Capital Meaning Examples Formula Importance Change Impact